Equifax Statutory Credit Report

The Equifax Statutory Credit Report is a free, standard report showing your credit history.

Already have an account? Login here

What is the Equifax Statutory Credit Report?

- Your free statutory credit report shows you the information Equifax has about your credit history. Your credit history is information that lenders may use when you apply for credit with them.

- Better yet, this standard report is accessible for life and is updated daily, upon login. Please note, it doesn‘t include the Equifax Credit Score or other premium features, which you can find below.

- Keeping an eye on your credit information before you apply for further credit can help to give you the best chance of receiving the credit you need when you need it.

Order your Free Statutory Credit Report now

There is more than one way to retrieve your Statutory Credit Report

Access Online

- Enter Personal Details

- Create Account

- Verify Identity

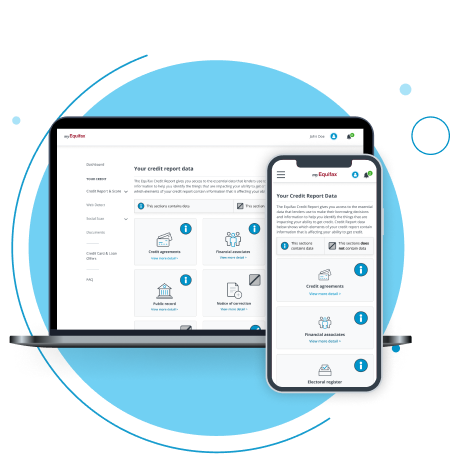

Once you have registered, you will have access to our improved member centre, now called myEquifax. From there, you can access and view your credit report online.

Request a paper copy

- Download paper application form here

- Fill out the application form.

- Mail the application form to:

Equifax Ltd, Customer Service Centre, PO Box 10036, Leicester LE3 4FS

A copy of your Statutory Credit Report will be posted to your home address as soon as possible but no longer than a calendar month.

Looking for a Business Report?

Sole traders or people in a business partnership are also legally entitled to request a Business Report by post. Please complete our Business Report form and post it to the address above.

It can be beneficial to know about these things before applying for any credit you may want or need for your business.

Is the Statutory Credit Report right for you?

The Equifax Statutory Credit Report holds all the credit information lenders may use to assess your creditworthiness. If you are applying for a mortgage and need to understand your credit data, credit score and how lenders might view you as a borrower or just want to make sure you are kept regularly advised of changes to your data, then our Equifax Credit Report & Score may prove more useful.

Find out below other benefits that might be necessary for you.

Take control of your credit score

Empower your financial future with an instant free credit score check. Plus, understand,monitor, and enhance your credit score using our handy traffic light system and tips.

Up to 3 users

One digital 12 month rewards card for the main user*

Unlimited Credit Score Access

Credit Score Tracker

Credit Report Alerts

Credit Report Traffic Light System

Credit Report Hints & Tips

Equifax WebDetect

Equifax SocialScan

Access to enhanced Equifax Credit Report

Access to Historical Credit Reports

Access to Knowledge Centre

Support from Customer Care Team

First 30 days FREE

then £22.95 a month.

You can cancel at any time.

Up to 3 users

One digital 12 month rewards card for the main user*

Unlimited Credit Score Access

Credit Score Tracker

Credit Report Alerts

Credit Report Traffic Light System

Credit Report Hints & Tips

Equifax WebDetect

Equifax SocialScan

Access to enhanced Equifax Credit Report

Access to Historical Credit Reports

Access to Knowledge Centre

Support from Customer Care Team

First 30 days FREE

then £14.95 a month.

You can cancel at any time.

Up to 3 users

One digital 12 month rewards card for the main user*

Unlimited Credit Score Access

Credit Score Tracker

Credit Report Alerts

Credit Report Traffic Light System

Credit Report Hints & Tips

Equifax WebDetect

Equifax SocialScan

Access to enhanced Equifax Credit Report

Access to Historical Credit Reports

Access to Knowledge Centre

Support from Customer Care Team

FREE

Statutory Credit Report

* Main user is eligible for one free digital 12 month tastecard. Access withdrawn upon cancellation of Equifax subscription

**Your first 30 days are free then it’s £22.95 a month for Equifax Family & Friends Plan or £14.95 a month for Equifax Credit Report & Score. You can cancel at any time.

Frequently asked questions

A Statutory Credit Report is a written report of your credit history. It makes it easy to understand what credit information is held about you by credit reference agencies. It is called 'statutory' because all consumers have a legal right to view it. A Statutory Credit Report shows your financial history, like loan repayments and credit card use. It details whether you've been late on payments or defaulted on loans.

This report is used to check your credit history. This can be important to know when you're applying for credit, such as a mortgage or loan, because lenders use this information to decide whether to lend to you and at what rate. It also lets you monitor your financial status and identify any errors in your credit history.

You can access your Statutory Credit Report from Equifax by registering online.

Once you have registered, you will have access to our improved member centre, now called myEquifax. From there, you can access and view your credit report online.

You can also print out or download your credit report as a PDF document

If you’re a sole trader or in a business partnership, by law, you’re entitled to request a copy of your Business Report to be sent to you by post. Please complete our Business Request form and post it to:

Equifax Ltd

Customer Service Centre

PO Box 10036

Leicester

LE3 4FS

A copy of your statutory credit report will then be posted to your home address within seven working days.

A Statutory Credit Report gives a snapshot of your credit history and key credit information.

The Report & Score service offers a more comprehensive view. This includes your credit score, as well as more detailed insights and regular updates.

The service also offers additional benefits like identity protection.

Yes. If you think that there is incorrect information on your Equifax Credit Report, please go to the Errors on my Credit Report section to raise a dispute. We will then manage the dispute with the data supplier on your behalf. Once the dispute has been raised, the company has 21 days to respond to it. While this is happening, we'll add a note to your Equifax Credit Report so that any organisations looking at it are aware that the information is under dispute.

Your Statutory Credit Report is updated daily upon login. However, different lenders might provide information to Equifax at different times, so updates to specific accounts can vary. Regularly checking your credit report can help you stay on top of any changes.