Navigating the challenges of social tariffs in the utilities and telecoms sectors

By Robert McKechnie

With rising costs of living, increasing consumer debt, and increased regulatory focus, utility companies are exploring innovative ways to offer social tariffs. Use of digital automation is a significant opportunity for these companies to support financially vulnerable customers while maintaining operational efficiency. Equifax's Tariff Connect is a groundbreaking solution that leverages Open Banking technology, transforming the process of assessing and offering social tariffs.

Understanding the economic landscape

In the UK, many households are struggling to meet their basic utility and telecom needs. According to Ofcom, 29% of households have difficulty affording their telecom bills1, whilst OFWAT reports that 15% struggle with water bills2. According to OFGEM, the number of households in debt and arrears has risen from 1.9 million to 2.3 million during 2023 (an increase of 20%)3.

4.3 million low-income families are in arrears with at least one household bill or credit commitment, and 1.2 million are in arrears with 4 or more bills4. And with nearly 6.4 million people relying on Universal Credit, the need for accessible social tariffs is greater than ever.

Telecom and utility companies are under increasing pressure to support these vulnerable customers. However, the process of identifying eligible customers and offering them reduced rates is fraught with challenges.

Ofcom's latest report states, “Ensuring that essential services are affordable for everyone is a priority, particularly as more families face financial pressures”(Ofcom - Communications Affordability Tracker).

Challenges faced by telecom and utility companies

- Identifying eligible customers

One of the biggest challenges for telecom and utility companies is accurately identifying customers who qualify for social tariffs. Traditional methods of verification often involve lengthy paperwork and require customers to provide proof of income or benefits, which can be cumbersome and error-prone.

This not only delays the support process but also creates barriers for customers who may be eligible but are unable or unwilling to navigate complex application procedures. -

Regulatory and compliance pressures

Regulatory bodies are increasingly pushing for utilities and telecom companies to provide better support to financially vulnerable customers. Companies want to ensure that financially vulnerable customers are on the right tariff while managing the operational implications of offering reduced rates. Balancing these demands requires careful planning and efficient processes.

In a recent statement, Ofgem highlighted the importance of innovation in this area, saying, "As we continue to navigate the energy crisis, innovation is key to ensuring that those who need help the most can access it quickly and efficiently" (Ofgem - Energy Affordability Report). - Cost constraints and

operational efficiency

Offering social tariffs involves significant cost considerations. Companies must manage the financial impact of reduced revenue while maintaining operational efficiency. Streamlining processes to minimise administrative burdens is essential, but this can be challenging with legacy systems and manual procedures. -

Enhancing customer experience

Beyond financial support, companies must also focus on improving the overall customer experience. Providing a seamless, user-friendly application process is crucial for encouraging adoption of social tariffs. This requires innovative solutions that simplify the process for both customers and service providers.

The role of technology in overcoming challenges

Technology plays a crucial role in addressing these challenges. By automating eligibility assessments and decision-making, companies can improve efficiency, reduce costs, and enhance the customer experience.

Solutions like Tariff Connect leverage Open Banking data to streamline the process, making it easier for both companies and customers to navigate the complexities of social tariffs.

Introducing Tariff Connect: a game-changer for social tariffs

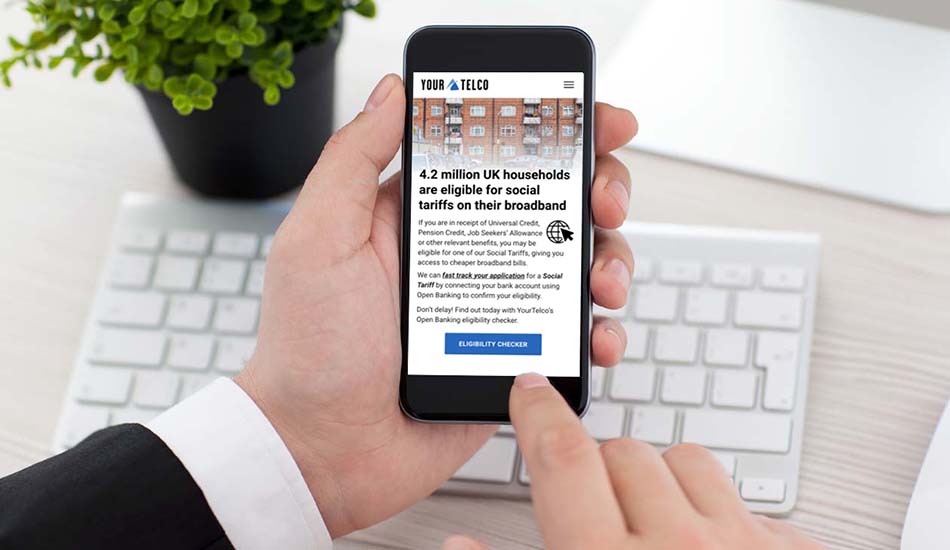

Equifax's Tariff Connect addresses the challenges faced by utilities and telecom companies by offering an innovative solution that leverages Open Banking technology. This allows companies to streamline the application process for social tariffs, helping them offer reduced bills to those in need effectively and in turn efficiently.

Simplified customer journey

Tariff Connect transforms the customer experience by integrating Open Banking technology to simplify and expedite the eligibility verification process. Customers can apply for social tariff discounts through a digital application platform that provides instant feedback on their eligibility, eliminating the need for manual paperwork and lengthy approval processes.

Efficiency gains and cost savings

Tariff Connect has revolutionised the way utilities and telecom companies assess eligibility for social tariffs, leading to significant efficiency gains and cost savings. By accessing real-time bank transaction data, the solution automates the eligibility assessment process, eliminating the need for manual documentation and back-and-forth communication.

For example, in our trial with a UK telecoms and broadband provider, the customer application journey was reduced from up to six weeks to less than ten minutes, resulting in an operational overhead saving of 90%. This not only speeds up the provision of financial support but also allows customer service agents to focus on more complex inquiries, enhancing overall service quality.

Realising the benefits of innovation

Driving consumer adoption and satisfaction

Tariff Connect has achieved remarkable success in driving consumer adoption and satisfaction. In a pilot with a UK telecoms and broadband provider, the number of customers with access to a social tariff increased by 230% within six months.

Another Equifax Open Banking partner, United Utilities, also reported that 35% of their customers chose the Open Banking route for their application, demonstrating strong consumer uptake.

This sort of innovation helps reduce average application times from weeks to minutes, reduces abandonment, improves accuracy and therefore increases acceptances, making it easy, quick and a better experience for the consumers.

Customer feedback from United Utilities’ customers during their Open banking trial period was overwhelmingly positive, with 100% of customers finding the Open Banking process easy to use and 80% willing to recommend it to others.

Overcoming traditional barriers

Tariff Connect addresses the traditional challenges of social tariff applications by digitising the entire process and leveraging Open Banking data for instant eligibility verification. This approach not only speeds up the process but also reduces the likelihood of errors and lost documents, leading to significant operational improvements. Importantly this makes it much easier to implement for our clients, with little requirement to integrate with the company’s own technology.

The UK government’s perspective

The Labour government has been vocal about the need for utilities and telecom companies to support struggling families. A recent statement from a spokesperson emphasised, “In these challenging times, it is vital that we ensure every family has access to essential services at a fair price. Innovation in how we deliver social tariffs is essential to achieving this goal” (Labour Party Conference 2024 - Labour's Energy and Utilities Policy).

Conclusion

Tariff Connect exemplifies how technology can be harnessed for societal good, particularly in the utilities and telecom sectors, where companies are striving to support struggling families.

By automating eligibility assessment and decision-making, Tariff Connect enhances operational efficiency, reduces costs, and significantly improves the customer experience.

The solution not only addresses critical legacy issues but also sets a new standard for industry practices and enables our clients to serve their customers who need their help and support to access cheaper bills, which is becoming increasingly important as cost of living continues to challenge many consumers financially.

More importantly, making it as easy as possible for the consumers to access lower tariffs is vital to help every consumer live their financial best.

As more water, energy, and telecom companies adopt solutions like this, the potential to support an even greater number of vulnerable customers grows, exemplifying how innovative technology can drive meaningful benefits for both businesses and individuals. We feel this could even be a replicable model for broader application, including in the public sector to improve access to government support.

Take the Next Step

Feel free to email me directly if you’re interested in learning more about how Tariff Connect can transform your customer support processes and enhance your operational efficiency.

Sources:

-

Ofcom - Communications Affordability Tracker

-

Ofwat - Cost of Living report

-

Ofgem - Affordability and debt in the domestic retail market 2024

-

Joseph Rowntree Foundation Reality for low-income households in May 2024

-

DWP Universal Credit statistics, 29 April 2013 to 11 January 2024

-

Ofgem - Energy Affordability Report

-

Labour Party Conference 2024 - Labour's Energy and Utilities Policy