In partnership with

Compare car finance deals

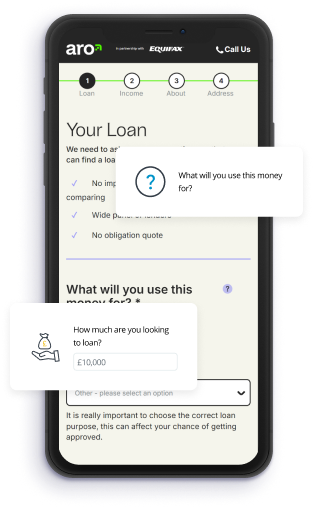

With loans, leases and hire purchase options all available, finding the right car finance option for your needs involves more than searching for the cheapest deal. By using the Equifax Marketplace, you can tap into Aro, a comparison tool that will discover products tailored for you without affecting your credit score.

Find affordable car finance with terms that suit you.

Car finance comparison that doesn’t affect your credit score

and many more

What is the best car financing deal for you?

To find the best car finance deal, you need to balance the affordability of the payments with the contract terms you’re signing up to. Having an idea of how much you can afford to pay monthly is a good idea when you start to look up financing options. Whether you have enough cash to make an initial deposit payment will also be a factor.

Then, when you’re comparing contract terms, you should consider the following:

Whether you have the option to own the car at the beginning or end of the contract.

If you have to pay fees for exceeding any maximum mileage restrictions.

Whether there are flexible or fixed repayment terms, as early termination fees may apply if you decide to end the agreement early.

How long the contract runs for and whether this will cover the amount of time you need the vehicle.

The total cost of the contract, including any additional fees or charges, to understand the full financial commitment.

Being flexible on having a used rather than a new car is likely to lower your monthly payments.

By comparing the different options carefully, you can help make sure you find a deal you can afford with the terms you want.

How does car finance work?

To finance a car with terms and costs that suit you, comparing deals is the recommended first step. Then, once you’ve found the best option, follow these steps to secure your vehicle.

- Before you sign on the dotted line, make sure the repayments are affordable and the contract terms (such as the time period) suit your needs.

- To confirm the agreement, it’s likely that you’ll need to make a down payment. The amount and terms of payment will be set out in the contract.

- Finance companies will usually ask you to set up a direct debit or standing order for your instalments. You can choose the account and date these payments are made.

- Depending on the terms of your contract, you’ll either own the car outright after your contract ends or can move onto a new finance deal.

What are the different types of car finance?

There are a variety of car finance options that will suit how much you want to pay, the length of time you want to keep the car for and the type of vehicle you want.

Personal car loan

Hire purchase (HP)

Personal contract purchase (PCP)

Car leasing

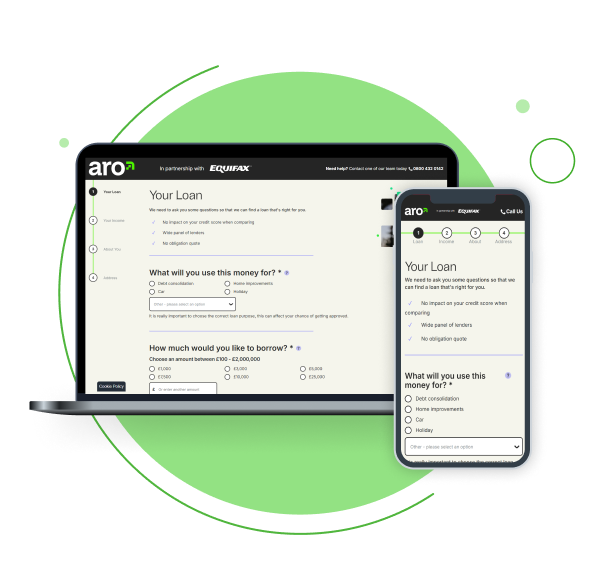

Who is aro?

Aro is Equifax’s chosen partner for car finance deals. Their comparison tool allows you to look at the details of each option side by side without impacting your credit score. Plus, the results are tailored to your financial and vehicle needs, helping you find the most affordable agreement with terms that suit you.

What is the best car financing deal for you?

To find the best car finance deal, you need to balance the affordability of the payments with the contract terms you’re signing up to. Having an idea of how much you want to pay monthly is a good idea when you start to look up financing options. Whether you have enough cash to make an initial deposit payment will also be a factor.

Then, when you’re comparing contract terms, you should consider the following:

Whether you have the option to own the car at the beginning or end of the contract

If you have to pay fees for exceeding any maximum mileage restrictions

If there are flexible or fixed repayment terms, as early termination fees may apply if you decide to end the agreement early

How long the contract runs for and whether this will cover the amount of time you need the vehicle

Being flexible on having a used rather than a new car is likely to lower your monthly payments

By comparing the different options carefully, you can make sure you find a deal you can afford with the terms you want.

| Personal car loan | Hire purchase | Personal contract purchase | Car lease | |

|---|---|---|---|---|

| Initial down payment required | No | Yes | Yes | Yes |

| Pay in monthly instalments | Yes | Yes | Yes | Yes |

| Car ownership option | You own the car outright from the beginning | You own the car once all the payments have been made | Option to buy the car with a ‘balloon payment’ when the contract ends | No ownership option |

| Value you’re paying off | The amount of money you’ve borrowed | The total value of the vehicle you’ve purchased | The depreciation value of the vehicle you’ve purchase | A set fee to cover the cost of your lease |

How much does car finance cost?

The cost of car finance will differ based on a variety of factors, including:

The value of the vehicle itself, with used cars typically being cheaper to finance

The value of the loan. For example, if you’re only paying off the depreciation value of a car on a PCP agreement, this will be lower than paying off the total value of a car on an HP contract

The amount of deposit you have to put down to secure the car

The length of time you’ll be repaying the cost over, the longer the term, the lower the monthly payments

Any interest rates applied on the money you’ve borrowed, ideally look for fixed-rate or low APR car finance options to pay as little as possible

What can I do if I've been mis-sold a car finance deal?

If you’re unhappy with your car finance deal and believe the terms of the contract haven’t been met adequately, then you can make a complaint to the Financial Ombudsman Service. Car finance agreements may be considered as mis-sold if:

The vehicle is faulty or not of the quality described

The agreement you signed up wasn’t as described

You’ve been over charged or charged a fee you weren’t expecting at the end of the contract

The length of time you’ll be repaying the cost over, the longer the term, the lower the monthly payments

Any interest rates applied on the money you’ve borrowed, ideally look for fixed-rate or low APR car finance options to pay as little as possible

They will ask you for relevant information and documents to help them consider all the facts. If they find in favour of your case, then you could be entitled to some compensation.

Can I get car finance with bad credit?

Yes, it is possible to get car finance with bad credit. However, if you have a low credit score, outstanding County Court Judgements (CCJs) or defaulted on loan payments in the past, then the types of finance you can get will be restricted.

There’s no specific credit score limit that would prevent you from getting car finance. However, it is worth running a soft search to see what finance deals are available to you without causing any further damage to your credit history.

How can I get cheaper car finance payments?

The best way to find cheap car finance is to shop around and compare deals to find an agreement that suits your needs and budget. Making certain changes to your search can also help you lower your car finance payments:

Switching to a used vehicle rather than a new model, as the overall value of older cars tends to be lower, meaning you need to borrow less to purchase it.

Extend the agreement length, as this will spread out the final cost over a longer period. Just keep in mind that you’ll pay more interest overall and might incur early termination fees if you decide to leave the contract.

Looking for deals with a fixed rather than variable interest rate, as this will not change and increase your monthly payments over the course of your contract.

How much car finance you can get will depend on factors such as how high your credit score is, your overall financial history and how much your monthly income is. The amount you want to borrow and the type of agreement you take will affect how much your monthly repayments will be.

If you’re already in an agreement and want to lower how much you’re paying, there are three main options.

Refinancing the car loan

Getting a new loan to replace your current one may help you reduce the amount you pay monthly. However, this is only likely to be the case if you can find a lender with a cheaper deal or have improved your credit score. If your financial circumstances haven’t changed, it’s unlikely you’ll find an agreement offering lower interest rates.

Extending the car loan

If you change the time period over which you’re repaying your loan, this could lower your monthly repayments. It also means interest rates will be applied over a longer period, so you could end up paying more overall.

Plus, it will mean you have to wait to own your car outright on an HP or PCP contract. Chatting with your lender about the different options will help you see how extending the agreement could affect your monthly payments.

Overpay your car finance

Any regulated agreement will allow you to put a lump sum of money towards paying off your car finance. Though it’s important to check if there are any early payment fees you need to settle.

Frequently asked questions

For example, if you want to own the car outright at the end of your agreement, you’ll need to have a large balloon payment available to pay off the value of the car on a PCP contract. This isn’t required on a HP deal, but the monthly payments are likely to be higher.