In partnership with

Compare Credit Cards

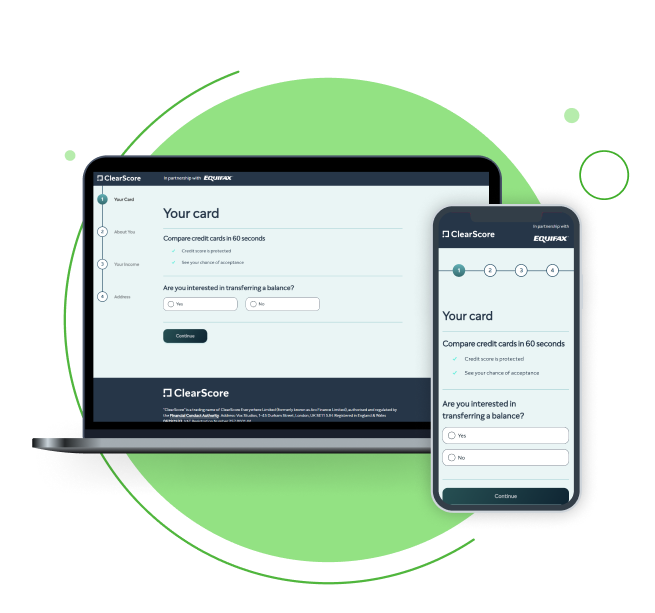

Compare credit cards from trusted providers with our easy-to-use credit card comparison tool. Discover rewards credit cards or compare balance transfer credit cards to find the most suitable option for you.

Credit Card comparison that doesn’t affect your credit score

and many more

How do credit cards work?

A credit card is a type of credit that is flexible up to a certain limit. Cards get issued with an agreed interest rate and spending limit. You can accrue debt or pay it off in monthly payments or at any time. Credit cards can be a suitable option for regular spending and expenses.

Types of credit cards

Find the Right Card For You

If you have a low credit score, you might be finding it hard to get a credit card. However, there are options available.Move Your Debt Into One Place

Put all your credit card balances onto one account and pay it off at a low interest rate for a fixed term.Compare terms and fees now.Get Perks When You Spend

Earn cashback, points, or other goodies when you spend on this type of credit card. Discover the extras you could get here.Enjoy 0% Interest Spending

Pay for everyday items, household bills, or occasional treats and pay no interest for a fixed term.Find a card that suits your needs.

Which type of credit card would work best for you?

When you use our credit card comparison tool, we will ask you what you want the credit card for. For example: transferring an existing balance, interest-free spending, or improving your credit rating.

Take a look at some of the reasons people use credit cards and think about why you are interested in comparing options.

Credit cards for bad credit

If you have poor credit history and are worried about getting accepted, there are credit cards for bad credit. These usually come with lower spending limits and higher interest rates. Credit builder cards help people with poor credit histories prove they can make repayments on time.

Credit cards for moving debt

You can also compare balance transfer credit cards with our tool. A balance transfer card lets you move debt from one card to another. It can have an interest-free period during which you pay no interest. There is often a balance transfer fee incurred, so it’s important to check the savings in interest payments outweigh the fee.

Credit cards for rewards

Credit cards for interest-free spending

Pros and cons of credit cards

Before comparing personal loans, weigh up the pros and cons to decide whether it’s the right option for you.

Advantages of credit cards

Interest-free borrowing

Plenty of credit card options offer 0% interest for an initial period, making it easier to make large purchases.

Purchase protection

Under Section 75 of the Consumer Credit Act, banks and lenders may be able to help you with refunds, repairs or replacements for problems with purchases made on a credit card.

Rewards

As long as you pay your bill every month, it’s possible to build up an array of rewards, cashback and perks with your credit card. This is especially advantageous for purchases that you would be making anyway.

Building credit

By using your credit card responsibly, you are proving to lenders that you are responsible with money and building your credit.

Disadvantages of credit cards

Temptation and misuse

With credit cards, you should always be careful to only spend what you are able to pay back. It’s possible to get into trouble and debt by misusing credit cards. If you are already struggling, a credit card may not always be the answer.

Penalties for poor management

Fees can be incurred for poor management of a credit card, for example paying late or missing payments altogether. This can also damage your credit score.

Related content

Frequently asked questions

If you can pay off your debt during that interest-free period, you will avoid paying interest on your debt.

However, always remember to pay careful attention to the cards’ terms and conditions. Plus, keep a close eye on spending and repayments if you're managing more than one card.

The limit will then be changed in line with your credit profile and your overall record as a borrower.

Contact your provider if you're having difficulty and they can help work out a payment plan.

Compare different offers widely and always read the terms carefully before making your final choice.