More than just a score

Checking your credit score won't harm it

*Free for 30 days then £14.95 a month. Cancel anytime.

Join the 28.8 million myEquifax™ users globally

across UK, USA, Canada and Australia as of March 2025

Compare loans, credit cards and car finance

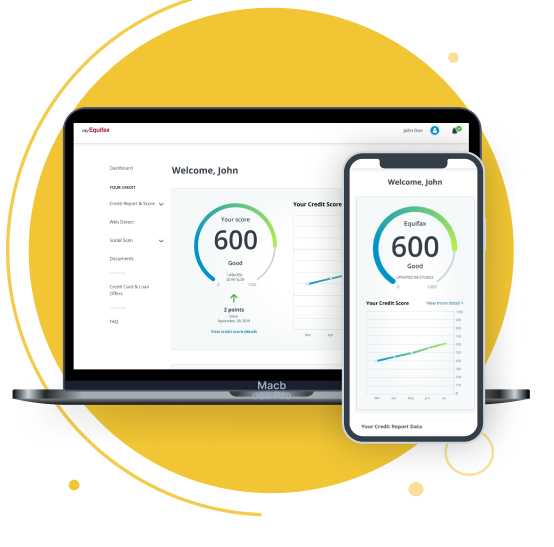

Features of the Equifax Credit Report & Score

Explore the features and benefits of the Equifax Credit Report & Score

Access to your credit report & score

Protect your identity

A free 12 month tastecard including Coffee Club

Our Products

Equifax

Family & Friends Plan

All the benefits of Equifax Credit Report & Score for up to 3 users, potentially saving £240 per year!

All features of Equifax Credit Report & Score for up to 3 adults

Daily credit alerts

24/7 Identity protection

Rewards with tastecard for the main account holder**

First 30 days FREE

then £22.95 a month.

You can cancel at any time.

Equifax

Credit Report & Score

A detailed view of your enhanced credit report and score out of 1000, including a range of Identity Protection features.

Score updated daily, upon login

Daily credit alerts

24/7 Identity protection

Rewards with tastecard**

First 30 days FREE

then £14.95 a month.

You can cancel at any time.

Equifax

Basic™

Our basic product includes your Equifax credit score, updated monthly, and your free statutory credit report, which shows you the information Equifax has about your credit history.

Score updated monthly

Statutory credit report included

FREE

Upgrade at any time.

*Your first 30 days are free then it’s £22.95 a month for Equifax Family & Friends Plan or £14.95 a month for Equifax Credit Report & Score. You can cancel at any time.

** Main user is eligible for one free digital 12 month tastecard. Access withdrawn upon cancellation of Equifax subscription

Practical tips on everyday money matters

Start your journey towards better financial well-being with our straightforward, jargon-free guidance. Find useful information and tips and tricks on a range of financial subjects.

Looking for business solutions?